Therapy isn’t just about the copay - here’s what else you’re really paying

You show up for your therapy session, swipe your card, and pay $30. That’s it, right? Maybe. But if you think that’s the full cost of therapy, you’re not alone - and you’re also not prepared for what’s coming.

Most people assume their copay is the total price. But that $30 is just one piece of a much bigger financial puzzle. Behind that simple payment are deductibles, coinsurance, out-of-pocket maximums, and hidden fees that can add up to thousands over the year. In fact, a 2024 study from Thriveworks found that the average therapy session without insurance costs $143.26. With insurance, your actual cost depends on how your plan works - and most patients don’t realize how much they’ll pay until they’re already deep into treatment.

What’s really in your insurance plan? Three common structures

Not all insurance plans are built the same. There are three main ways your plan handles therapy costs: copay, deductible, and coinsurance. Each one changes how much you pay - and when.

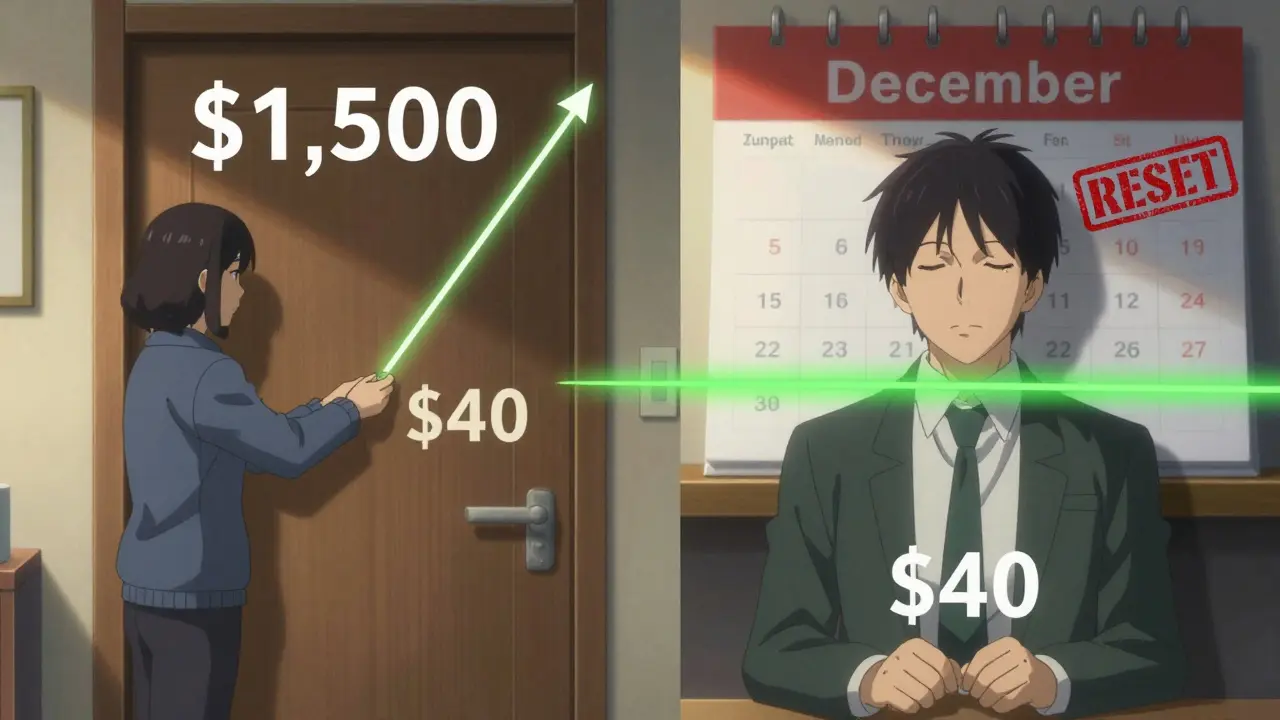

Copay plans are the simplest. You pay a fixed amount per session - say $30 - no matter what the therapist charges. Sounds easy. But here’s the catch: you still have to meet your deductible first if your plan requires it. Some plans have a $0 copay only after you’ve paid your full deductible. So if your deductible is $1,500 and each session costs $125, you’ll pay $125 per session until you’ve spent $1,500. That’s 12 sessions before your $30 copay even kicks in.

Deductible plans mean you pay the full cost of therapy until you hit your deductible. Once you do, your copay or coinsurance kicks in. If your deductible is $3,000 and you’re seeing a therapist weekly at $125 per session, you’ll pay $125 for 24 sessions before your insurance starts helping. That’s $3,000 out of pocket - just to get to the point where your copay applies.

Coinsurance plans are the trickiest. After you meet your deductible, you pay a percentage of the cost. Most plans use 20% or 30%. But here’s what nobody tells you: the percentage is based on the insurance company’s allowed amount, not the therapist’s actual fee. If your therapist charges $150, but your insurer only allows $120, you pay 20% of $120 - not $150. That’s $24 per session. But if you go out-of-network, you might pay 40-50% of the full fee. That’s a huge difference.

In-network vs. out-of-network: A $100 difference per session

Choosing an in-network therapist isn’t just about convenience - it’s about money. In-network providers have agreed to charge your insurer a set rate. Out-of-network providers don’t, so your insurance pays less - or nothing at all.

Let’s say you’re paying $125 per session. If your therapist is in-network and your coinsurance is 20%, you pay $25 after your deductible. If they’re out-of-network, your plan might only cover 50% of the allowed amount - which could be $100. So you pay 50% of $100 = $50. That’s $25 more per session. Do that 20 times? That’s $500 extra in one year.

And if you’re out-of-network, you might have to pay the full fee upfront and wait for reimbursement. That’s cash flow trouble for anyone on a tight budget. In 2023, Alma found that out-of-network patients paid 40-50% of session costs after deductible - compared to 20-30% for in-network. That gap doesn’t disappear. It compounds.

How many sessions do you actually need?

Most people think therapy is a quick fix. It’s not. According to Grow Therapy, 12-16 sessions are typical for noticeable improvement. But for complex issues like PTSD, depression, or anxiety with trauma, 15-20 sessions are common - and 50% of patients need even more.

So if you’re paying $30 per session for 20 sessions, that’s $600. Sounds manageable. But if you’re paying $125 per session before your deductible is met? That’s $1,500 before you even hit your $30 copay. And if you’re on coinsurance? You’re paying 20% of $125 for 20 sessions after your deductible - that’s $500 more.

Now add in the fact that therapy often starts slowly - maybe once every two weeks - then ramps up to weekly. Your costs aren’t steady. They spike. And if your deductible resets on January 1st? You’re starting over. That’s why timing matters. Starting therapy in December? You might pay full price for two sessions that count toward your next year’s deductible. That’s wasted money.

Your out-of-pocket maximum isn’t a safety net - it’s a ceiling

Every plan has an out-of-pocket maximum. In 2024, that’s $9,350 for individuals and $18,700 for families. That’s the most you’ll pay in a year for covered services - including therapy, doctor visits, prescriptions, and lab tests.

But here’s the catch: that maximum doesn’t include your monthly premiums. You’re still paying those. And not all services count toward the same deductible. Some plans have separate deductibles for medical and mental health care. So even if you’ve hit your $9,350 limit for doctor visits, your therapy costs might still be piling up.

Once you hit your out-of-pocket maximum, your insurance covers 100% of therapy costs for the rest of the year. That’s great - if you know you’ll get there. But if you’re paying $50 per session and you need 40 sessions? You’re already at $2,000. You’re not even halfway to your maximum. You still have a long way to go.

What about Medicare and Medicaid?

If you’re on Medicare, therapy is covered at 80% after you meet your Part B deductible. That means you pay 20%. For a $143 session, that’s about $28.65. Sounds low - until you realize you’re paying that for every session, all year. And if you’re on Original Medicare, you’ll need a Medigap Plan G to cover the 20% and the deductible. That plan costs $150-$250 per month. So now you’re paying $28.65 per session plus $200/month for your supplement. That’s $2,400 extra a year just for coverage.

Medicaid is different. Most Medicaid plans have little to no copay for therapy. But not all therapists accept it. In some areas, only 1 in 5 providers take Medicaid. So even if the cost is low, finding someone can be the real barrier.

What if you don’t have insurance?

One in five Americans pay for therapy without insurance. For them, the cost isn’t hidden - it’s front and center. But it’s not always $143 per session.

Thriveworks found that 42% of private practice therapists offer sliding scale fees based on income. That can cut costs by 30-50%. So a $125 session could drop to $60 or $70. Open Path Collective offers sessions for $40-$70 to uninsured people. University training clinics, staffed by supervised grad students, charge 50-70% less than private providers.

These aren’t second-rate options. They’re legitimate, licensed professionals getting supervised experience. Many patients report the same quality of care - and often more time per session.

How to calculate your real cost - step by step

Here’s how to figure out what therapy will actually cost you - not what your insurance card says.

- Find your plan type. Is it copay, deductible, or coinsurance? Call your insurer or log into your portal. Don’t assume.

- Check your deductible. How much have you paid so far this year? How much is left?

- Know your coinsurance percentage. Is it 20%? 30%? And what’s the allowed amount for therapy in your area?

- Confirm in-network status. Is your therapist in-network? If not, what’s your out-of-network benefit?

- Estimate your sessions. Are you planning 12 sessions? 20? 30? Be realistic.

- Calculate in phases.

- Phase 1: Pay full price until deductible is met.

- Phase 2: Pay copay or coinsurance after deductible.

- Phase 3: Once you hit your out-of-pocket max, you pay nothing.

- Add extras. Transportation, missed work, parking, even childcare. These aren’t part of your insurance - but they’re part of your cost.

Example: You have a $1,500 deductible, $40 copay after that, and a $9,350 out-of-pocket max. You see a therapist at $125/session and plan for 20 sessions.

- First 12 sessions: $125 x 12 = $1,500 (meets deductible)

- Next 8 sessions: $40 x 8 = $320

- Total: $1,820

Without insurance? $2,500. With insurance? $1,820. That’s a $680 saving - but only if you knew to look beyond the copay.

Tools to help you track it

You don’t have to do this alone.

- Your insurance portal often has a cost estimator. Search for "therapy" or "mental health" and enter your provider’s name.

- Alma’s Cost Estimator lets you plug in your deductible and copay to see how much you’ll pay per session - before and after meeting your deductible.

- Rula reports their users pay an average of $15/session with insurance - but that’s because they match you with providers who accept your plan’s negotiated rates.

- GoodRx tracks out-of-pocket costs across therapies and medications. Useful if you’re also on prescriptions.

Don’t wait until your bill arrives to find out you owe $800. Call now. Ask the questions. Write it down.

Bottom line: Your copay is just the tip

Therapy is one of the most important investments you can make in your health. But it’s also one of the most expensive - if you don’t understand how the system works.

The $30 copay you see on your card? It’s not the price. It’s just the last piece. The real cost is hidden in your deductible, your coinsurance, your network status, and how many sessions you actually need.

Don’t guess. Don’t assume. Calculate. Use the tools. Ask your insurer. Track your spending. And if you’re uninsured? Sliding scales and community clinics exist - and they work.

You’re not just paying for an hour with a therapist. You’re paying for your mental health. Make sure you know exactly what that costs - before you start.

Is my copay the only thing I pay for therapy?

No. Your copay is just one part. You might also pay your full deductible before the copay applies, coinsurance after the deductible, and out-of-network fees if your therapist isn’t in your plan’s network. Plus, you still pay monthly premiums. The copay is the visible cost - not the total.

What’s the difference between deductible and out-of-pocket maximum?

Your deductible is the amount you pay before your insurance starts sharing costs. Once you hit that, you pay coinsurance or a copay. Your out-of-pocket maximum is the most you’ll pay in a year for covered services - including your deductible, copays, and coinsurance. After that, your insurance pays 100% for the rest of the year.

Do therapy sessions count toward my medical deductible?

Usually, yes - but not always. Most plans combine medical and mental health deductibles. But some have separate ones. Check your plan documents or call your insurer. If you’re paying for other medical services (like blood tests or doctor visits), those can help you meet your mental health deductible faster.

Can I use my HSA or FSA to pay for therapy?

Yes. Therapy is a qualified expense for both Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). You can use those funds to pay for copays, coinsurance, or even full-session fees if you’re uninsured. Just keep receipts - you may need them for audits.

Why does my out-of-network therapy cost so much more?

Out-of-network providers don’t have negotiated rates with your insurer. So your plan pays less - sometimes only a fraction of what they charge. You’re responsible for the rest. That means you pay a higher percentage of the full fee, and you might have to pay upfront and wait for reimbursement. In-network providers are cheaper because they’ve agreed to lower rates in exchange for more patients.

What if I can’t afford therapy even with insurance?

You’re not alone. Many therapists offer sliding scale fees based on income - often 30-50% off. Open Path Collective connects uninsured people with therapists charging $40-$70 per session. University training clinics also offer low-cost services through supervised students. Don’t give up - affordable options exist, even if they require some legwork to find.

13 Comments

February 1, 2026 Carolyn Whitehead

I wish I'd known this before I started therapy. I thought my $25 copay was it. Turns out I paid $1,200 just to hit my deductible. No one warned me.

Now I track every session in a spreadsheet. It's weirdly satisfying.

February 1, 2026 Amy Insalaco

The structural inefficiencies inherent in the American healthcare reimbursement paradigm are frankly pathological. The conflation of actuarial risk pools with provider-network arbitrage creates perverse incentives that commodify therapeutic labor while externalizing fiscal burden onto the patient-consumer. The notion that a copay constitutes 'cost' is a neoliberal myth propagated by insurance cartels to obscure the true price of psychosocial care.

February 2, 2026 Marc Bains

This is exactly why we need universal mental health coverage. I'm a Black man who's been in therapy for 5 years. I've paid out of pocket, used insurance, switched providers - none of it's easy. But I kept going because my mental health matters. If you're reading this and scared of the cost? Start with a sliding scale. You deserve this.

February 2, 2026 Rob Webber

Insurance companies are literally robbing people blind. They'll take your money, then make you jump through 17 hoops just to get a $20 reimbursement. I had to sue my insurer to get paid for 6 sessions. Don't trust them. Ever.

February 4, 2026 Lisa McCluskey

I used Open Path. Paid $50/session for 18 months. My therapist was a grad student. Super smart. Felt more listened to than my previous private practice therapist. No drama. Just good work.

February 6, 2026 owori patrick

In Nigeria, therapy is mostly private pay and very expensive. But I've seen people form support circles - share therapists, split group sessions, use WhatsApp for check-ins. Community care works even without insurance. We don't wait for systems to fix themselves.

February 8, 2026 Claire Wiltshire

It is imperative to distinguish between the nominal copayment and the aggregate out-of-pocket expenditure. Many individuals erroneously conflate the two, resulting in significant financial miscalculations. Furthermore, the utilization of Health Savings Accounts (HSAs) for qualified mental health services is not only permissible but highly advisable for tax optimization and cost mitigation.

February 9, 2026 Russ Kelemen

I used to think therapy was about fixing broken parts. Now I see it as paying for someone to sit with you while you untangle the knots you didn’t even know you were holding. The money? It’s not just for the hour. It’s for the presence. The consistency. The courage it takes to show up. And yeah - the system’s broken. But your healing? That’s still worth it.

February 10, 2026 Adarsh Uttral

bro i paid 140 a session and thought it was normal till i read this now im switching to university clinic lmao

February 10, 2026 April Allen

The structural asymmetry between in-network and out-of-network reimbursement protocols creates a bifurcated access paradigm where socioeconomic status becomes a proxy for therapeutic continuity. The allowed amount, as a construct, is not a reflection of clinical value but of contractual negotiation - a mechanism that systematically devalues the labor of providers who refuse to participate in insurer-driven rate suppression.

February 11, 2026 Sarah Blevins

This post is dangerously misleading. You're implying people should feel guilty for not understanding insurance. Most people can't even read their own EOBs. This isn't a knowledge gap - it's a predatory system. Stop normalizing it.

February 13, 2026 Holly Robin

THEY KNOW. THEY ALL KNOW. Insurance companies are in cahoots with therapists to keep you paying. They want you broke so you stay dependent. They track your sessions and raise rates when you're vulnerable. I saw my therapist's billing code - it's not even called therapy. It's 'Behavioral Health Intervention - Tier 2'. They're selling you a product. Don't fall for it.

February 13, 2026 Shubham Dixit

In India, we don't have this problem because we have real values. Therapy is for weak people who can't handle pressure. Why waste money? Just pray, work harder, and stop being so soft. Our ancestors didn't have therapists - they had discipline. You Americans think money can fix everything. It can't. Character can.

Write a comment