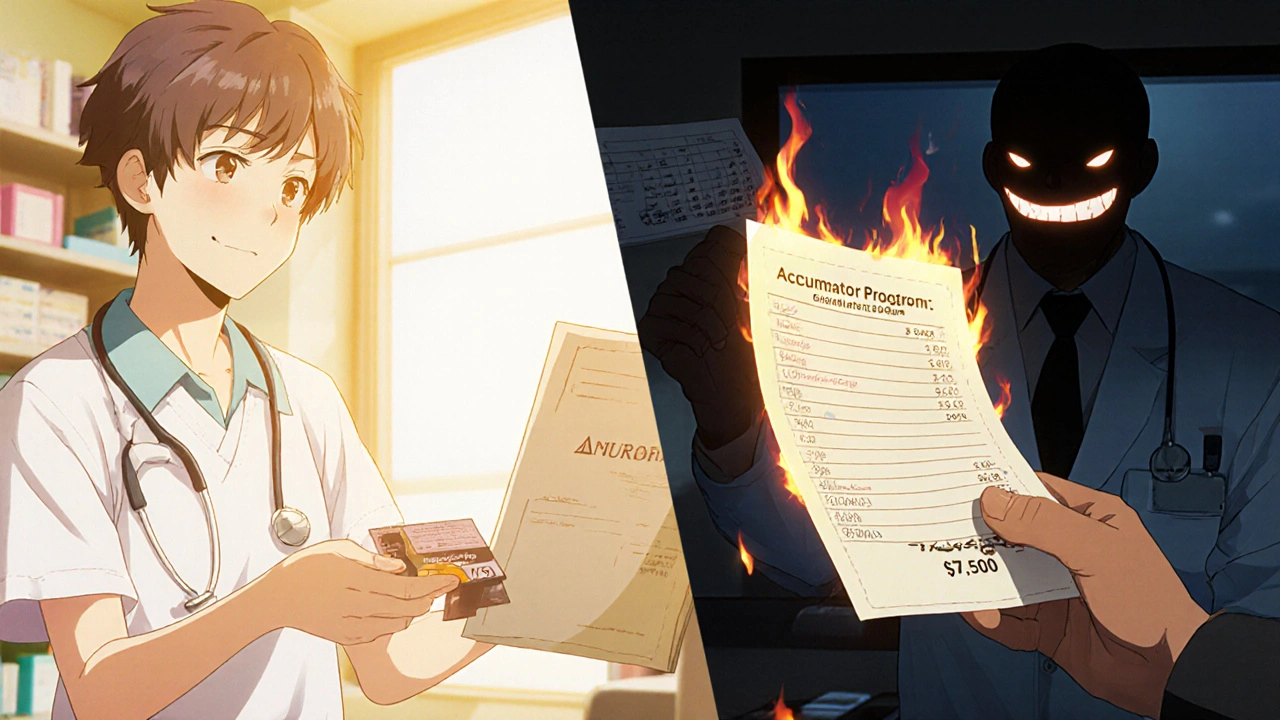

When you’re managing a chronic illness and your medication costs thousands a month, a copay card can feel like a lifeline. It slashes your out-of-pocket expense from $8,000 to $10. But what happens when that card runs out? For many, the shock isn’t just financial-it’s life-altering. You’ve been paying $10 a month for two years, thinking you’re getting closer to hitting your deductible. Then, one day, your pharmacy says your copay is now $7,500. And your deductible? Still at zero.

What Copay Cards Actually Do

Copay cards are offered by drug manufacturers to help people with commercial insurance afford specialty medications. These cards cover part or all of your copayment, so you pay less upfront. They’re common for drugs used to treat conditions like multiple sclerosis, rheumatoid arthritis, cancer, and rare diseases. The average card saves patients $500 to $1,000 per fill, with annual limits between $5,000 and $25,000. According to the National Multiple Sclerosis Society, 72% of specialty drugs now come with some form of manufacturer assistance. But here’s the catch: copay cards only work for people with private insurance. If you’re on Medicare, Medicaid, or any government plan, you’re not eligible. That’s because federal law bans drug companies from giving financial help to government beneficiaries-it’s considered an illegal kickback.The Hidden Trap: Copay Accumulator Programs

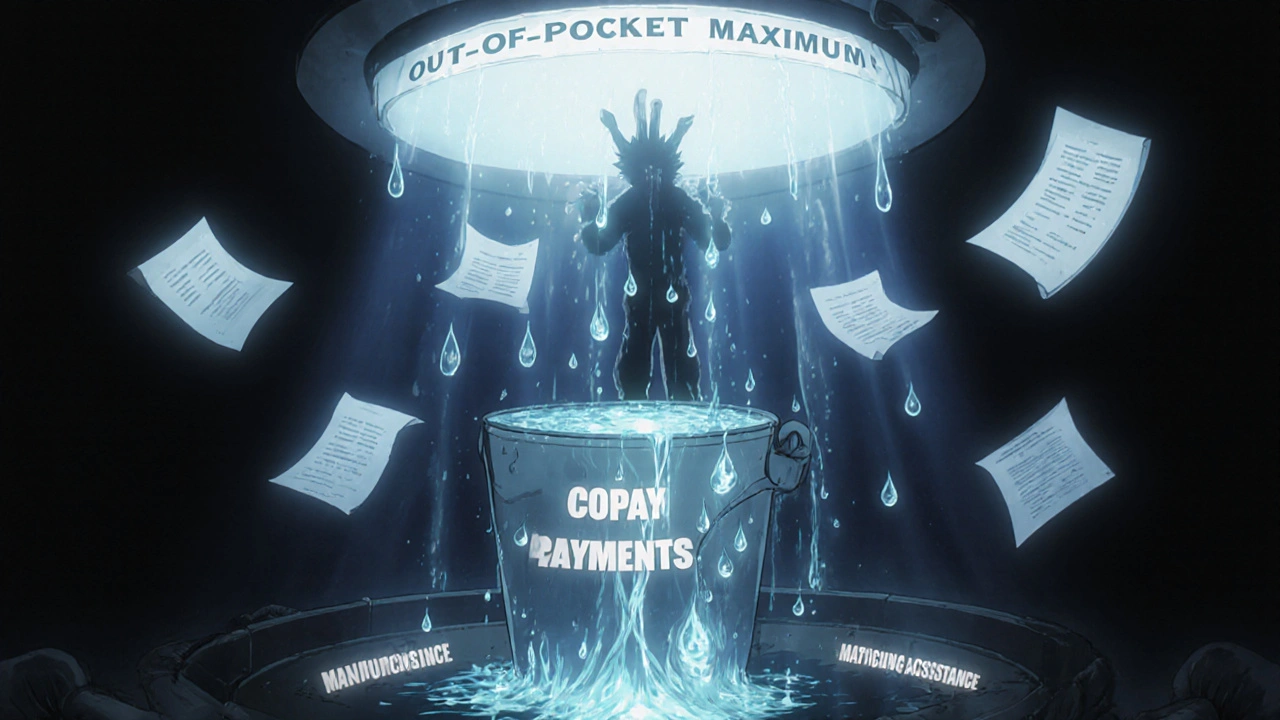

The real danger isn’t the card itself. It’s what happens after you use it. Starting around 2016, insurance companies began using something called copay accumulator programs. These programs let drug manufacturers pay your copay-but they don’t count that payment toward your deductible or out-of-pocket maximum. So even though you’re paying less each month, you’re not getting any closer to the point where your insurance starts covering 100% of your medication. Think of it like this: You’re filling a bucket with water. The copay card is a hose that’s pouring water in. But the bucket has a hole at the bottom. The water flows in, but it never adds to your total. You keep filling, but you’re never closer to full. By 2024, 56% of commercial insurance plans had adopted accumulator programs. Among self-insured employer plans, that number jumps to 67%. That means most people using copay cards are unknowingly playing a rigged game.How Accumulators Hurt Patients

A 2021 study published in the Journal of the American Medical Informatics Association found that patients on accumulator programs were 23.4% more likely to stop taking their medication. Why? Because when the card runs out, they’re suddenly hit with a bill they can’t afford. One patient on the National MS Society forum shared: “My $7,500 monthly medication became $10 after using the copay card for two years. When it expired, I discovered my $7,000 deductible was still completely untouched-I had to stop treatment for three months.” That’s not an outlier. Reddit threads like r/HealthInsurance show that 82% of patients who used copay cards reported a “Copay Surprise”-the moment they realized their manufacturer payments didn’t count toward their deductible. For people with conditions like lupus or Crohn’s disease, stopping treatment isn’t an option. But without money, they have no choice.What’s Worse? Copay Maximizer Programs

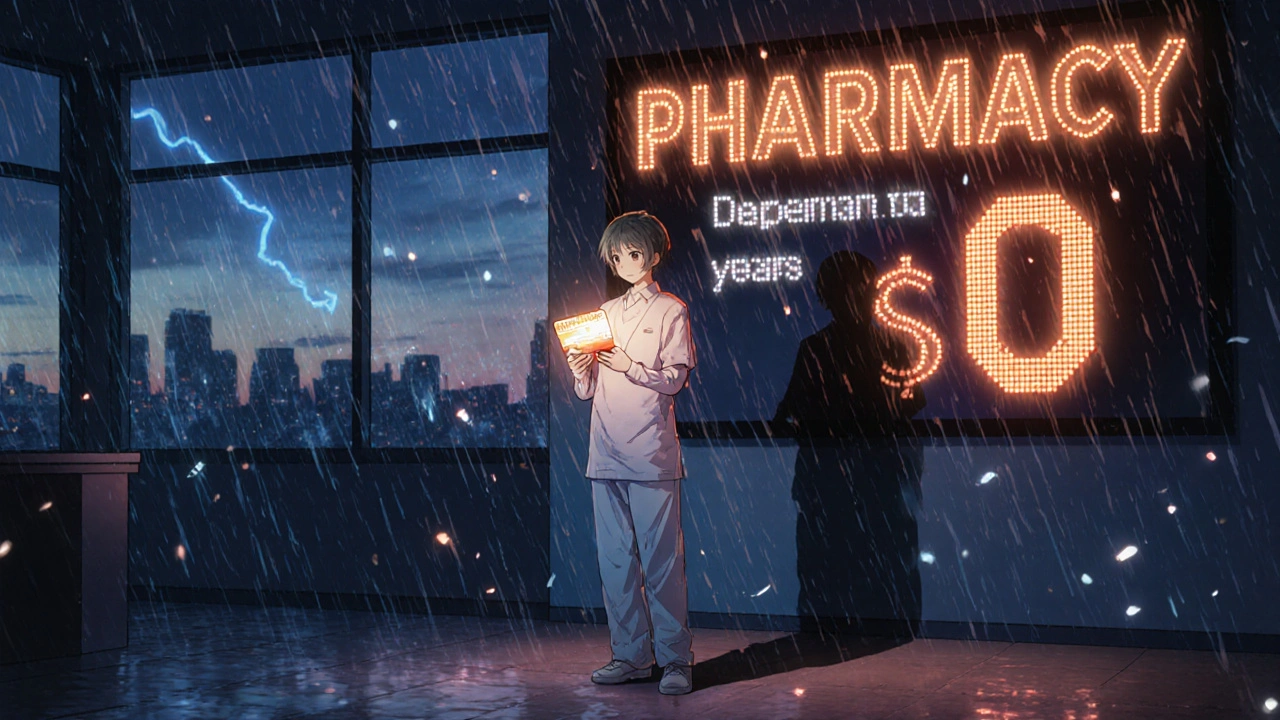

Some insurers don’t just ignore the manufacturer payment-they use it to manipulate your costs. That’s called a copay maximizer program. These programs set your copay to exactly match the maximum amount the manufacturer will pay. So you pay $0. Sounds great, right? But here’s the twist: because you’re not paying anything, your insurance doesn’t count it toward your deductible. You’re stuck at $0 progress. Even if you’ve spent $10,000 on medication, your deductible remains untouched. When the card runs out, your next bill is the full cost of the drug-no partial coverage, no built-up progress. According to Optum Business Insights, 42% of large insurers now use maximizer programs. They’re cheaper for insurers in the short term but cost patients far more in the long run.

How to Use Copay Cards Safely

You don’t have to be caught off guard. There are steps you can take to protect yourself. Ask these three questions before using a copay card:- Does my insurance plan have a copay accumulator or maximizer program?

- How much of my deductible have I actually met so far?

- What happens when this card runs out? Will I owe the full price immediately?

What’s Changing in 2025 and Beyond

There’s some good news. In September 2024, the Department of Health and Human Services proposed a new rule requiring insurers to clearly disclose accumulator programs during enrollment. Starting January 1, 2026, you’ll get monthly statements showing your true deductible progress-no more hidden holes in the bucket. CVS Caremark is already rolling out transparency dashboards for some patients, showing exactly how much of your deductible has been met, regardless of accumulator rules. But right now, that’s only available to 28% of commercially insured Americans. Congress is also stepping in. The Copay Accumulator Moratorium Act, introduced in 2023, has 72 bipartisan sponsors and could ban these programs for three years while their impact is studied. The pharmaceutical industry, however, spent $28.7 million lobbying against it in early 2024.Who’s Most at Risk?

Patients on long-term biologic therapies for autoimmune diseases are the most vulnerable. These drugs often cost $10,000 to $15,000 a month. Most copay cards only last 12 to 24 months. If your condition requires lifelong treatment, you’ll eventually hit the wall. A 2024 Optum report found it takes patients an average of 4.2 months to understand how accumulator programs affect them. By then, it’s often too late to switch plans or find alternatives.

What to Do If You’re Already Caught

If you’ve already used your card and just realized your deductible is still at zero, don’t panic. There are still options:- Ask your drug manufacturer if they offer a patient assistance program for after the card expires. Many do.

- Contact nonprofit foundations like the Patient Access Network Foundation or the Chronic Disease Fund. They give grants to help cover costs.

- Work with your doctor to see if there’s a lower-cost alternative or generic option.

- Appeal your insurance decision. Some insurers will make exceptions if you can prove medical necessity.

The Bigger Picture

Copay cards were meant to help. They’ve saved lives. But when insurers change the rules without telling you, they turn a tool of access into a trap. The system is broken-not because manufacturers are greedy, but because the financial incentives are misaligned. Drug companies make money when people stay on their drugs. Insurers make money when patients pay more out of pocket. And patients? They’re caught in the middle. The solution isn’t to eliminate copay cards. It’s to make the system transparent. To stop hiding the hole in the bucket. To make sure the help you’re given actually counts. By 2027, experts predict that new rules and disclosure standards will reduce treatment discontinuation by 22%. That’s not just a number-it’s thousands of people who won’t have to choose between their health and their bank account.Can I use a copay card if I’m on Medicare or Medicaid?

No. Federal law prohibits drug manufacturers from offering copay assistance to people enrolled in Medicare, Medicaid, or other government health programs. This is to prevent illegal kickbacks. If you’re on one of these plans, you may qualify for a different type of patient assistance program directly from the manufacturer, but it won’t come in the form of a copay card.

How do I know if my insurance has a copay accumulator program?

Call your insurance company’s member services line and ask directly: “Does my plan use a copay accumulator or maximizer program for specialty medications?” Don’t rely on your pharmacy or doctor’s office-they often don’t have access to your plan’s specific rules. You can also check your Summary of Benefits and Coverage (SBC) document, which should list any such restrictions.

What’s the difference between a copay accumulator and a maximizer program?

A copay accumulator program lets the manufacturer pay your copay, but doesn’t count that payment toward your deductible or out-of-pocket maximum. A maximizer program sets your copay to exactly match the maximum the manufacturer will pay-so you pay $0-but still doesn’t count it toward your deductible. Both prevent you from making progress, but maximizers make it look like you’re paying nothing, which can be more misleading.

Do copay cards expire?

Yes. Most copay cards have an annual maximum, usually between $5,000 and $25,000, and are valid for one year. Some expire after a set number of fills. The card will typically show the expiration date or total value. Always check the fine print or ask your pharmacist when you receive the card.

What should I do if my copay card runs out and I can’t afford my medication?

Contact your drug manufacturer-they often have a patient assistance program for people who’ve used up their copay card. You can also reach out to nonprofit organizations like the Patient Access Network Foundation, the Chronic Disease Fund, or the HealthWell Foundation. These groups offer grants to help cover medication costs. Your doctor or pharmacist can help you apply.

Are there any new laws protecting patients from accumulator programs?

Yes. Starting January 1, 2026, insurers must clearly disclose whether they use accumulator or maximizer programs during enrollment and provide monthly statements showing your true progress toward your deductible. This rule was proposed by the Department of Health and Human Services in September 2024. Additionally, the Copay Accumulator Moratorium Act, with 72 bipartisan sponsors, could ban these programs for three years while their impact is studied.

8 Comments

November 28, 2025 Katrina Sofiya

This is one of the most important posts I’ve read all year. I’ve been on a biologic for lupus for five years, and I had no idea my copay card wasn’t counting toward my deductible until I got hit with a $9,000 bill out of nowhere. I cried in the pharmacy parking lot. No one warned me. No one even asked if I understood how it worked. This system is designed to make you feel grateful for crumbs while the bucket drains beneath you.

November 29, 2025 jaya sreeraagam

Thank you for writing this with such clarity. I’m from India but my sister lives in the US with RA and she’s been through this nightmare. I showed her this and she said she finally understands why her insurance rep kept saying ‘you’re doing great’ while her deductible stayed at zero. The analogy of the bucket with a hole? Perfect. I’m sharing this with every support group I’m in. Also, typo: ‘copay’ not ‘copay’ - wait no I mean copay. Ugh. Anyway. This matters.

December 1, 2025 kaushik dutta

Let’s cut through the noise. This isn’t a ‘system failure’-it’s a predatory financial engineering scheme masquerading as healthcare. Drug manufacturers are incentivized to lock patients into lifelong dependency on their $15K/month biologics. Insurers are incentivized to shift costs onto patients while pretending they’re ‘helping.’ The only winners are the actuaries and the shareholders. And we’re the ones paying with our kidneys, our jobs, and our dignity. Stop calling this ‘access.’ It’s a debt trap with a branded logo.

December 2, 2025 doug schlenker

I work in patient advocacy and I see this every single day. The worst part? Most patients don’t even realize they’ve been manipulated until it’s too late. I had a client last month who had been on a copay card for 22 months-paid $10/month-and then got hit with $12,000. She thought she’d been ‘saving’ money. She hadn’t. She’d been paying rent on a house she didn’t own. The system doesn’t just fail people-it gaslights them. Thank you for naming it.

December 3, 2025 Olivia Gracelynn Starsmith

Biggest takeaway: Always ask your insurer directly. Don’t trust your pharmacy. Don’t trust your doctor’s office. Call the number on the back of your card. Ask: ‘Do you use accumulators or maximizers?’ Write it down. Save the confirmation. I’ve seen people get denied care because they didn’t document it. Also-ask about the 80% alert. If your pharmacy doesn’t offer it, demand it. You’re not being difficult. You’re being smart.

December 4, 2025 Skye Hamilton

So… you’re saying the whole thing is a lie? Like… a big, sparkly, ‘we care about you’ lie wrapped in a rainbow copay card? And we’re the fools who believed it? Wow. I feel so seen. Also, my cat just knocked over my coffee and now my keyboard is sticky. Coincidence? I think not.

December 4, 2025 Maria Romina Aguilar

But… what if… the manufacturers… are… just… trying… to… help…? And… maybe… the insurers… are… just… trying… to… control… costs…? And… maybe… patients… are… just…… too… emotional… to… see… the… bigger… picture…? I mean… I’m not saying it’s right… but… is it… really… all… black… and… white…?

December 4, 2025 Brandon Trevino

Statistically, 82% of patients report a ‘Copay Surprise’-yet 78% of those patients failed to read their Summary of Benefits and Coverage document. The problem isn’t systemic malice. It’s patient negligence. You’re handed a 47-page booklet. You don’t read it. You assume the card is a free pass. Then you blame the system. Wake up. The burden of due diligence is on you. Not the insurer. Not the manufacturer. You. Read. The. Fine. Print.

Write a comment